Home MaharashtraMaharashtra Lok Sabha Election 2024 Phase 3 LIVE: Senas Face Off In 13 Maharashtra Seats, BJP vs Congres...

Home BusinessVande Bharat Sleeper Trains To Replace Rajdhani Express? Here’s What Reports Say The Vande Bharat sleeper t...

Home West BengalRain Brings Much Needed Relief From Heat In Kolkata, Neighbouring Districts: WATCH VIDEO Light to modera...

Home SportsHardik Pandya Gives Rohit Sharma Sigh Of Relief With Clinical Bowling Show Ahead Of T20 World Cup 2024 Hardik...

Home NewsRahul Gandhi Plotting To Overturn Ram Mandir Verdict Via ‘Superpower Commission’: Acharya Pramod’s EXPLOSIVE Cl...

Home SportsMeet Anshul Kamboj – Mumbai Indians’ Unluckiest Bowler Who Dismissed Travis Head Twice On IPL Debut Anshul Ka...

Home NewsLok Sabha Election 2024 Phase 3: PM Modi Will Cast His Vote At THIS Polling Booth; Know Details Voting for 25 o...

Home KarnatakaAttention Bengaluru: Traffic Advisory Issued Ahead Of Lok Sabha Polls On May 7 | Check Alternate Routes Be...

Home EntertainmentAbhishek Bachchan Joins Housefull 5 With Akshay Kumar and Riteish Deshmukh, Fans Can’t Control Excitem...

Home SportsT20 WC 2024 Terror Threat: ICC Official Claims ‘Working Closely With Host Countries’ to Avoid Mishaps The men...

Home SportsIPL 2024: MI v SRH Overall HEAD-TO-HEAD Record; Timing And Live Streaming DEETS Hardik Pandya's Mumbai Indian...

New York: A bomb threat e-mail was received by over two dozen synagogues, Jewish institutions, temples upstate and on Lo...

National News

Vande Bharat Sleeper Trains To Replace Rajdhani Express? Here’s What Reports Say

Rain Brings Much Needed Relief From Heat In Kolkata: WATCH VIDEO

Hardik Pandya Gives Rohit Sharma Sigh Of Relief With Clinical Bowling Show Ahead Of T20 World Cup 2024

Rahul Gandhi Plotting To Overturn Ram Mandir Verdict Via ‘Superpower Commission’: Acharya Pramod’s EXPLOSIVE Claim

Meet Anshul Kamboj – Mumbai Indians’ Unluckiest Bowler Who Dismissed Travis Head Twice On IPL Debut

Lok Sabha Election 2024 Phase 3: PM Modi Will Cast His Vote At THIS Polling Booth; Know Details

Attention Bengaluru: Traffic Advisory Issued Ahead Of Lok Sabha Polls On May 7 | Check Alternate Routes

Abhishek Bachchan Joins Housefull 5 With Akshay Kumar and Riteish Deshmukh, Fans Can’t Control Excitement

ICC Official Claims ‘Working Closely With Host Countries’ to Avoid Mishaps Following Terror Threat

IPL 2024: MI v SRH Overall HEAD-TO-HEAD Record; Live Streaming DEETS

Bomb Threat: Disturbing email received to over two dozen NYC synagogues, Jewish institutions in New York

Uttarakhand News

-

मुख्य सचिव ने वनाग्नि को नियंत्रित किए जाने के सम्बन्ध में दिए गए निर्देशों कि क्रियान्वयन बैठक ली

Chief Secretary took a meeting to implement the instructions given regarding controlling forest fire.

-

मुख्य निर्वाचन अधिकारी उत्तरारखण्ड ने उत्तरकाशी जिले में स्ट्रॉंग रूम एवं मतगणना केन्द्र का निरीक्षण किया

Chief Electoral Officer Uttarakhand inspected the strong room and counting center in Uttarkashi district.

-

उत्तराखंड में हीट वेव का अलर्ट, स्वास्थ्य विभाग ने जारी की एडवाइजरी

Heat wave alert in Uttarakhand, health department issued advisory

-

उत्तराखंड की विशेषताओं और संभावनाओं को राष्ट्रीय फलक पर रखने में सहयोगी बने पीआरएसआई: बंशीधर तिवारी

PRSI should become an ally in putting the characteristics and possibilities of Uttarakhand on the national platform: Ban...

-

पुलिस महानिदेशक, उत्तराखण्ड द्वारा चारधाम यात्रा-2024 को सकुशल सम्पन्न कराये जाने के निर्देश दिये

Director General of Police, Uttarakhand gave instructions to ensure safe completion of Chardham Yatra-2024.

-

फिक्की फ्लो उत्तराखंड चैप्टर ने स्वस्थ्य शिविर में 125 लोगों की मुफ्त जांच की गयी

FICCI FLO Uttarakhand Chapter conducted free screening of 125 people in the health camp.

-

he Aryan School announces the results of Class 10th and 12th Board Examinations

he Aryan School announces the results of Class 10th and 12th Board Examinations

-

जनपद हरिद्वार अंतर्गत अग्रिम आदेशों तक फसलों की पराली, गन्ने की पत्तियों आदि को जलाने पर पूर्णतः प्रतिबंध

Complete ban on burning of crop stubble, sugarcane leaves etc. in Haridwar district till further orders.

-

किसान को हाथी ने पटक पटककर मार डाला

रुड़की के बुग्गावाला क्षेत्र में खेत में रखवाली कर रहे एक किसान को हाथी ने पटक पटककर मार डाला। किसान की मौत से गुस्साए ग...

-

12 मई को धाम के कपाट खुलने के दिन बदरीनाथ बंद का आह्वान

चारधाम यात्रा में ऑनलाइन बुकिंग में तीर्थयात्रियों की संख्या सीमित करने के निर्णय का चारधाम होटल एसोसिएशन और बदरीनाथ होट...

-

जंगल में आग लगाने वालों पर कठोर दंडात्मक कार्रवाई के दिए निर्देश

Instructions given for strict punitive action against those who set fire in the forest

-

केदारनाथ हेली सेवा के लिए रद्द टिकटों से खाली हुई सीटों की बुकिंग के लिए आज खुलेगा पोर्टल

केदारनाथ हेली सेवा के लिए रद्द टिकटों से खाली हुई सीटों की बुकिंग के लिए सोमवार को आईआरसीटीसी पोर्टल खुलेगा। इससे हेलिकॉ...

World News

-

Israel rejects ceasefire proposal and presses ahead with ‘targeted strikes’ on Rafah

Israel has rejected a ceasefire proposal accepted by Hamas and announced it is pushing ahead with an assault on the town...

-

‘I wanted her to have a future’: Dad’s grief as he buries daughter, 7, crushed to death on overcrowded migrant boat

There are times when a person is so gripped with helpless despair that they are lost within themselves. Ahmed Alhashimi,...

-

US soldier detained in Russia, officials say

A US soldier was detained in Russia over the weekend while on a private trip, according to officials.The soldier, who ha...

-

Russia summons UK ambassador after Lord Cameron says Ukraine ‘has right’ to strike inside Russia with UK weapons

Russia has warned that Ukrainian strikes on its territory with UK-supplied weapons could bring retaliatory attacks again...

-

Ecce Homo: Painting once up for auction for €1,500 confirmed as rare Caravaggio work

A painting that had been up for auction for just €1,500 (£1,285) has been confirmed as a lost work of Italian master Mic...

-

Eurovision 2024: Who will win this year’s show and the acts to look out for

The 68th Eurovision Song Contest is taking place in Malmo, Sweden, this year.It's a spiritual homecoming of sorts with S...

-

Body of British man Joop Sparkes found in Prague river after search

The body of a missing British holidaymaker - who disappeared after reportedly jumping off a party boat in Prague - has b...

-

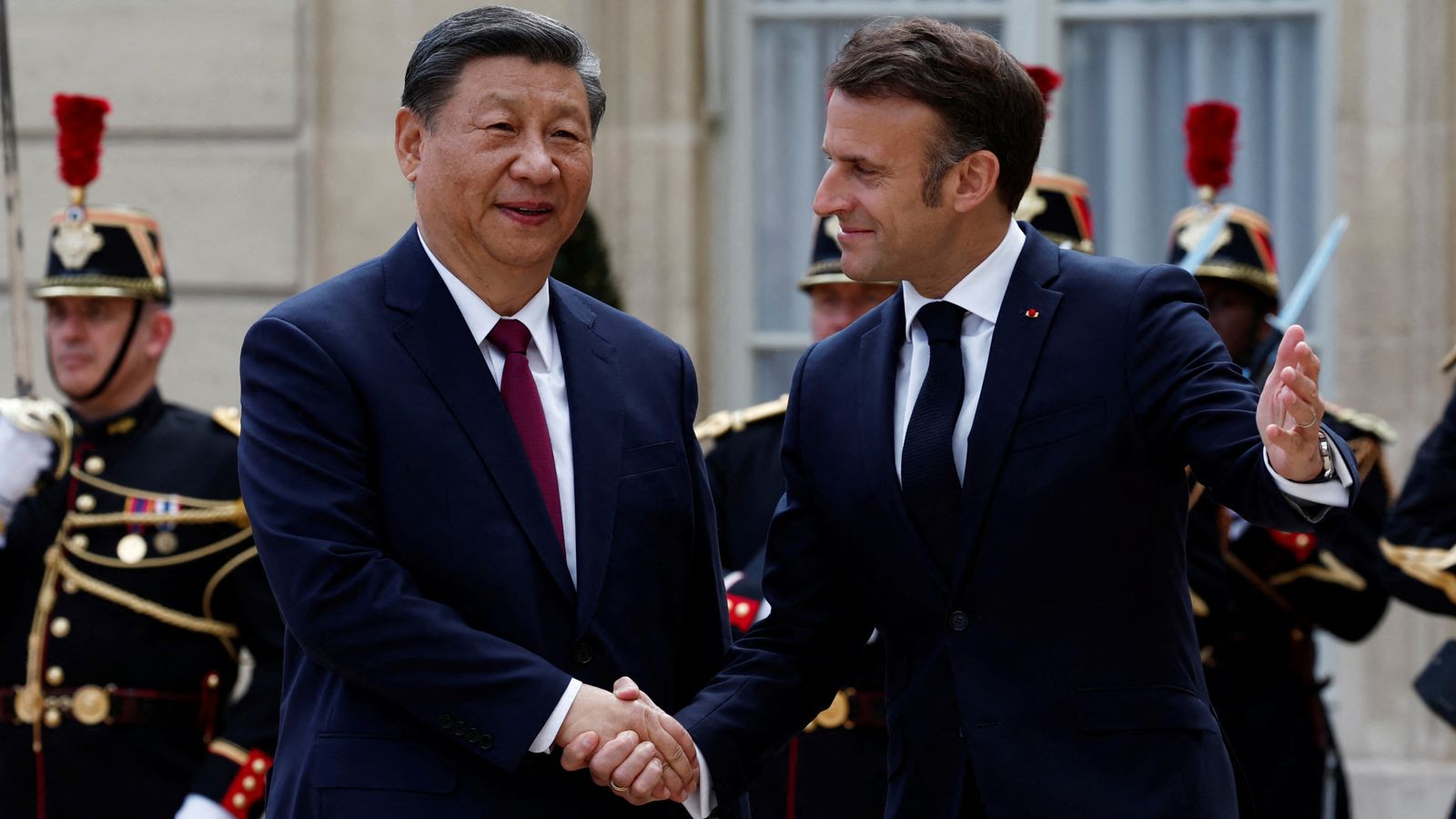

Tough talks ahead as China’s Xi Jinping touches down in Paris for European trip

President Xi Jinping has arrived in France for his big trip to Europe - it's been five years since his last visit and EU...

-

Kristi Noem: Joe Biden’s dog Commander ‘should be put down’, opponent who shot and killed her own dog suggests

Joe Biden's dog - which has bitten US Secret Service staff several times - should be put down, a political opponent, who...

-

Lithium mine being built on ‘sacred ground’ where Native Americans say they were massacred

It could be a scene from centuries ago. In the Nevada desert, Native Americans are protesting over a mining project they...

-

UK considered using Iraq to process asylum seekers in Rwanda-type deal, leaked documents show

The government at one point considered using Iraq to process asylum seekers - like the Rwanda scheme - according to docu...

-

Lando Norris ends Max Verstappen’s winning streak with first Formula One win

Lando Norris has ended Max Verstappen's winning streak by securing the first victory of his career at the Miami Grand Pr...

Sports News

-

IPL 2024: MI vs SRH Today’s Match Highlights: Unmissable video recap, turning points, match analysis, stats, and more

The encounter played out at the Wankhede Stadium wasn't a run-fest of sorts, like how we'd witnessed at the Rajiv Gandhi...

-

IPL 2024: Match 55, Stats Review: Most centuries for Mumbai Indians and other stats from MI vs SRH – CricTracker

While it only moved them from no. 10 to no. 9 on the points table, Mumbai Indians still stomped over SRH at the Wankhede...

-

MI vs SRH: 3 Positive signs for Team India ahead of 2024 T20 World Cup

In a high-pressure clash between Mumbai Indians and Sunrisers Hyderabad, Mumbai Indians emerged victorious, clinching a...

-

IPL 2024: 3 Changes SRH should make to get back to winning ways

Mumbai Indians (MI) are back on the winning track with a seven-wicket win over dominant Sunrisers Hyderabad (SRH). But w...

-

Delhi vs Rajasthan, Match 56: DEL vs RJS MPL Opinio Today’s Prediction – Who will win? – CricTracker

PreviewDelhi (DEL) will lock horns against Rajasthan (RJS) in the 56th match of the Indian T20 League 2024 on Tuesday (M...

-

‘Never seen a team out of race before 13-14 games’ – Harshal Patel optimistic about Punjab Kings’ playoffs chances

Punjab Kings went down by 28 runs against the five-time Champions Chennai Super Kings in the Indian Premier League encou...

-

May 6: IPL 2024 Evening News – Top updates on players, teams, stats, points table, and more

1. Deep Dasgupta expects Rohit Sharma to deliver in remaining matches keeping mega-auction in mindDeep Dasgupta believes...

-

‘With her by my side, the world is a wonderful place’ – Jasprit Bumrah’s wholesome birthday wish for wife Sanjana Ganesan

Star Indian pacer Jasprit Bumrah posted a wholesome message for his beloved wife, Sanjana Ganesan, on the occasion of he...

-

ICC reveals nominees for April Player of the Month awards

The International Cricket Council (ICC) has unveiled the latest lists of contenders hoping to claim the ICC Men’s and Wo...

-

‘He is scoring, but one player cannot win the match’ – Wasim Akram gives his take on Virat Kohli’s strike-rate debate

Indian star batter Virat Kohli's strike rate has been the topic of discussion in the ongoing IPL 2024, with some experts...

-

SRH XI against MI | Predicted Sunrisers Hyderabad playing 11 against Mumbai Indians for 55th Match of IPL 2024

Sunrisers Hyderabad (SRH) led by Pat Cummins will take on Hardik Pandya’s Mumbai Indians (MI) in the 55th game of the In...

-

Sunrisers Hyderabad’s: IPL Records and Stats against MI

Sunrisers Hyderabad (SRH) will lock horns against Mumbai Indians (MI) in Match 55 of IPL 2024 (Indian Premier League), a...

Trending Business News

-

Godrej Consumer Products Q4 Results: Net loss at Rs 1,893 crore, revenue up almost 6%

Godrej Consumer Products Q4 Results: Mumbai-headquartered Godrej Consumer Products (GODREJCP) on Monday reported a conso...

-

Starbucks founder Schultz says company needs to refocus on coffee as sales struggle

Former Starbucks CEO and founder Howard Schultz says the company’s leaders should spend more time in stores and focus on...

-

KKR to acquire medical device firm Healthium From Apax Funds

Global investment firm KKR on Monday said it has acquired medical device firm Healthium Medtech from an affiliate of fun...

-

Kamdhenu Q4 profit grows 56% to Rs 17 crore; company raising Rs 100 crore

Steel maker Kamdhenu Ltd on Monday posted a 56 per cent rise in net profit to Rs 16.8 crore in the March quarter compare...

-

1000% Dividend: Godrej Consumer announces Rs 10 dividend alongwith Q4 results

The board of directors of Mumbai-based consumer products maker Godrej Consumer Products on Monday, May 6, recommended a...

-

Britannia expects double-digit volume growth after general election, monsoon: Varun Berry

Leading food products company Britannia Industries expects a "double-digit growth" in volumes post general elections and...

-

Superplum raises USD 15 million from investors to expand fresh fruits business

Agritech startup Superplum, which sells premium fresh fruits, on Monday said it has raised USD 15 million from investors...

-

Arvind Ltd Q4 profit rises 7.32 pc at Rs 104.42 crore

Textiles manufacturer Arvind Ltd on Monday reported a 7.32 per cent rise in consolidated net profit at Rs 104.42 crore i...

-

Lupin Q4 Results Preview: Net profit likely to more than double, margin may expand by 700 bps

Lupin Q4 FY24 Results Preview: Mumbai-headquartered pharmaceutical company Lupin is all set to report its financial resu...

-

REC gets RBI’s nod to set up subsidiary in Gujarat’s GIFT City

Leading government-owned financial company REC on Sunday said it has received a nod from the Reserve Bank of India (RBI)...

-

This multi bagger stock company announces 215% dividend

J&K Bank dividend: Jammu and Kashmir Bank reported its fourth-quarter results on Saturday (May 4). Along with the Q4...

-

7350% dividend in Q4: FMCG major Britannia Industries announces Rs 73.5 dividend

The board of directors of FMCG major Britannia on Friday, May 3, recommended a final dividend of Rs 73.5 per equity shar...

Entertainment

-

मेट गाला में ईशा अंबानी लगीं बला की खूबसूरत, 10 हजार घंटे में बना गाउन – India TV Hindi

Image Source : INSTAGRAM ईशा अंबानी। बिजनेस वुमन और मुकेश-नीता अंबानी की बेटी ईशा अंबानी इस साल मेट गाला 2024 का हिस्सा...

-

‘तुम्हारा कोई हक…’ इब्राहिम अली खान के पोस्ट पर करीना का ये काॅमेंट हुआ वायरल – India TV Hindi

Image Source : X करीना का काॅमेंट वायरल बॉलीवुड एक्टर सैफ अली खान और एक्स वाइफ अमृता सिंह के बेटे इब्राहिम अली खान ने कु...

-

कौन-कौन से स्टार्स होंगे मेट गाला 2024 में शामिल, क्या होगी थीम? जानिए सारी जानकारी – India TV Hindi

Image Source : X जानिए कब-कहां शुरू होगा मेट गाला 2024 फैशन से जुड़ा सबसे बड़ा इवेंट मेट गाला 2024 (Met Gala 2024) आज या...

-

‘गुम है किसी के प्यार में’ सवी का ससुर करेगा तमाशा, जंग का मैदान बनेगी चाय की दुकान – India TV Hindi

Image Source : X गुम है किसी के प्यार में 'गुम है किसी के प्यार में' इन दिनों लगातार जबरदस्त और धमाकेदार ड्रामे देखने को...

-

योद्धा बनकर दिल जीतने आ रहे हैं ध्रुव विक्रम, ‘बाइसन कालामादान’ की शूटिंग शुरू – India TV Hindi

Image Source : X 'बाइसन कालामादान' की शूटिंग शुरू ध्रुव विक्रम की अपकमिंग फिल्म 'बाइसन कालामादान' लंबे समय से सुर्खियों...

-

भतीजी के साथ पोज देने के चक्कर में संजय लीला भंसाली ने इस एक्ट्रेस को किया साइड – India TV Hindi

Image Source : X भंसाली ने भतीजी को लाइमलाइट में रखने के लिया ये काम संजय लीला भंसाली के निर्देशन में बनी वेब सीरीज 'हीर...

-

रेखा ने ऐसा क्या कह दिया कि रो पड़ी मनीषा कोइराला? ‘मल्लिका जान’ ने किया खुलासा – India TV Hindi

Image Source : X रेखा की बात सुनकर रो पड़ी थीं मनीषा संजय लीला भंसाली के निर्देशन में बनी वेब सीरीज 'हीरामंडी' को रिलीज...

-

‘पुष्पा’ और ‘केजीएफ’ को भी एक्शन में धूल चटाएगी ‘कांगुवा’, हॉलीवुड से आए हैं एक्सपर्ट – India TV Hindi

Image Source : INSTAGRAM बॉबी देओल और सूर्या। 'कांगुवा' इस साल रिलीज होने वाली सबसे बड़ी और धमाकेदार फिल्म होने वाली है।...

-

‘द ग्रेट इंडियन कपिल शो’ के बारे में ये क्या बोल गए सुनील पाल, कहा- पता नहीं क्या सच – India TV Hindi

Image Source : INSTAGRAM कपिल शर्मा-सुनील पाल 'द ग्रेट इंडियन कपिल शो' जो 30 मार्च को ओटीटी पर शुरू हुआ था। वहीं इस शो क...

-

करीना कपूर के 8 साल के बेटे तैमूर ने दिया इस मुश्किल सवाल का सटीक जवाब – India TV Hindi

Image Source : INSTAGRAM करीना कपूर और तैमूर अली खान। करीना कपूर खान और सैफ अली खान के बेटे तैमूर अली खान अपने पेरेंट्स...

-

करीना कपूर के छोटे लाडले ने पकड़ी जिद, पापा सैफ के पास बैठने के लिए हाथ छुड़ाकर भागे – India TV Hindi

Image Source : INSTAGRAM जहांगीर अली खान। करीना कपूर खान और सैफ अली खान बॉलीवुड के पावर कपल हैं। दोनों ही सोशल मीडिया पर...

Technology News

-

iQOO Z9x launch date in India confirmed: Check expected features

iQOO Z9x launch date in India: iQOO has officially confirmed the launch date of its next smartphone - iQOO Z9x - in Indi...

-

Apple’s iPhone 15 Pro Max best-selling smartphone in Q1 this year, says report

Apple's iPhone 15 Pro Max was the best-selling smartphone of the first quarter (Q1) of 2024, a new report showed on Mond...

-

Instagram adds new stickers for Stories: Users can add music, frames, reveal, cutouts stickers – All you need to know

Instagram Sticker for Stories: Meta-owned Instagram has introduced new stickers in Instagram Stories. According to the s...

-

India emerged as the most preferred market for tech giants: Apple CEO Tim Cook

India has become a key market for global tech giants, with a burgeoning developer base attracting significant attention....

-

IBM expands software availability to 92 countries in AWS Marketplace, including India

IBM has announced an expansion in the availability of its software portfolio, making it accessible in 92 countries throu...

-

Elon Musk’s X cracks down on deepfakes with improved image matching

Tesla and SpaceX CEO Elon Musk, on Saturday, said that a new update on "improved image matching" will defeat deepfakes a...

-

Indian Bike Driving 3D Cheat Codes May 2024 List

Indian Bikes Driving 3D is a popular Android game which is a spinoff of the GTA franchise. The game brings all the eleme...

-

Understanding Peer-to-Peer Crypto Trading: Benefits and Threats

When two individuals or entities decide to exchange any asset directly between each other, this process is referred to a...

-

AMD set to fuel growing demand for AI compute, says CTO

Chipmaker AMD is poised to power the surging demand for AI compute with its wide range of product portfolio, the company...

-

HCL Tech, Cisco launch ‘Pervasive Wireless Mobility as-a-Service’ for secured connectivity across enterprises

"HCLTech and Cisco launch Pervasive Wireless Mobility as-a-Service...This brings secure and mission critical connectivit...

-

Amazon Great Summer Sale: iPhone 15, iPhone 14 Listed With Discounts

Amazon Great Summer Sale 2024 is currently live for all shoppers after giving 12 hours of early access exclusively to Pr...

-

Best Smart TV Deals Under Rs. 30,000 During Amazon Great Summer Sale 2024

Amazon Great Summer Sale 2024 kicked off in India at 12am IST on May 2 for Amazon Prime members and is now accessible to...

Know about online

-

iQOO Z9x launch date in India confirmed: Check expected features

iQOO Z9x launch date in India: iQOO has officially confirmed the launch date of its next smartphone - iQOO Z9x - in Indi...

-

Apple’s iPhone 15 Pro Max best-selling smartphone in Q1 this year, says report

Apple's iPhone 15 Pro Max was the best-selling smartphone of the first quarter (Q1) of 2024, a new report showed on Mond...

-

Instagram adds new stickers for Stories: Users can add music, frames, reveal, cutouts stickers – All you need to know

Instagram Sticker for Stories: Meta-owned Instagram has introduced new stickers in Instagram Stories. According to the s...

-

India emerged as the most preferred market for tech giants: Apple CEO Tim Cook

India has become a key market for global tech giants, with a burgeoning developer base attracting significant attention....

-

IBM expands software availability to 92 countries in AWS Marketplace, including India

IBM has announced an expansion in the availability of its software portfolio, making it accessible in 92 countries throu...

-

Elon Musk’s X cracks down on deepfakes with improved image matching

Tesla and SpaceX CEO Elon Musk, on Saturday, said that a new update on "improved image matching" will defeat deepfakes a...