Home EntertainmentHeeramandi: Meet Jason Shah, British-Indian Actor Who Played Evil Cartwright in Sanjay Leela Bhansali’...

Home News‘We Will Have To Wait For…’ S Jaishankar Reacts To 3 Indians Being Arrested By Canadian Police In Hardeep Singh...

Home AstrologyAstrological Predictions For May 5, 2024: How Will Luck Favour Taurus And Gemini Today? Astrological Predi...

Home SportsFACT CHECK: Did Virat Kohli’s THIS Six Leave Anushka Sharma Stunned During RCB vs GT IPL 2024 Match? Anushka...

Home SportsPBKS vs CSK Dream11 Team Prediction, IPL 2024 Match 53: Punjab Kings vs Chennai Super Kings Fantasy Hints Cap...

Home SportsAnushka Sharma’s GOOFY Reaction After Virat Kohli Survives Runout During RCB vs GT IPL 2024 Match Goes VIRAL...

Home SportsVirat Kohli’s REMINDS Mohammed Siraj After Plan Against Shubman Gill Works During RCB vs GT IPL 2024 | VIRAL...

Home EntertainmentDid Shahid Kapoor’s Two Famous Exes Cheat on Him? Actor Spills the Beans in Viral Video – WATCH Shahid...

Home NewsSapra’s Musical Voyage Is A Testament of Hard work, Dedication And Perseverance | Read His Inspirational Journe...

Web Desk Updated: May 04, 2024 2:12 PM IST Srinagar, the summer capital of Jammu and Kashmir, is a city in India located...

Home LifestyleSummer Care: A Step-by-Step Guide To Keep Your Nails Stylish, Stronger And Fabulous Don't let the sun and...

National News

‘We Will Have To Wait For…’ S Jaishankar Reacts To 3 Indians Being Arrested By Canadian Police In Hardeep Singh Nijjar Murder

Astrological Predictions: How Will Luck Favour Taurus Today?

FACT CHECK: Did Virat Kohli’s THIS Six Leave Anushka Sharma Stunned?

PBKS vs CSK Dream11 Team Prediction, IPL 2024 Match 53: All You Need to KNOW!

‘GOOD Charm’: Anushka’s GOOFY Reaction After Kohli Survives Runout BREAKS Internet!

KING For a Reason! Kohli’s ‘Bola Tha Na’ Gesture to Siraj After Plan vs Gill Works is GOLD!

Did Shahid Kapoor’s Two Famous Exes Cheat on Him? Actor Spills the Beans in Viral Video

Sapra’s Musical Voyage Is A Testament of Hard work, Dedication And Perseverance | Read His Inspirational Journey

Revealing The Ideal Time For Planning A Trip To Srinagar

Summer Care: A Step-by-Step Guide To Keep Your Nails Stylish, Stronger And Fabulous

Uttarakhand News

-

उत्तरकाशी के मनेरी झील में नौकायन का लुत्फ उठा पाएंगे श्रद्धालु

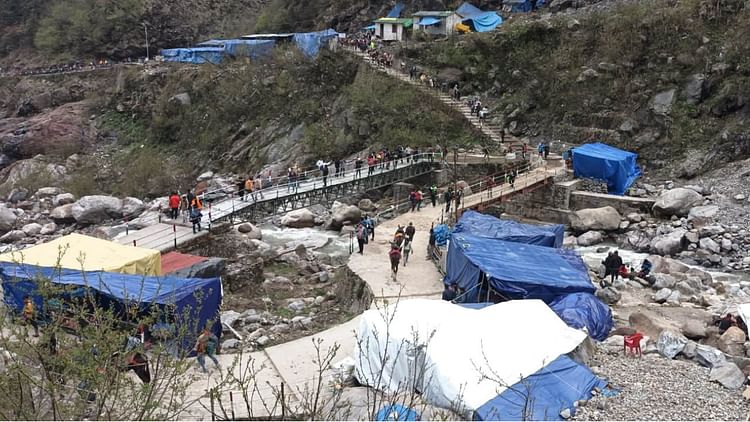

चारधाम यात्रा के साथ श्रद्धालु इस वर्ष तीर्थयात्री मनेरी में नौकायन का लुत्फ उठा पाएंगे। जिला साहसिक खेल प्रबंधन समिति...

-

सुगम और सुरक्षित चारधाम यात्रा के लिए पुलिस को अतिरिक्त सर्तकता बरतने के निर्देश

Instructions to police to exercise extra vigilance for smooth and safe Chardham Yatra

-

अति संवेदनशील है केदारनाथ पैदल मार्ग

प्रधानमंत्री नरेंद्र मोदी के ड्रीम प्रोजेक्ट के तहत बाबा केदार की नगरी केदारनाथ धाम को सुरक्षित करने के साथ ही सजाया और...

-

Olympus High Honors A+ Achievers

Olympus High Honors A+ Achievers

-

धरासू बैंड के पास आठ मई बंद होगी आवाजाही

यमुनोत्री हाईवे पर धरासू बैंड के पास भूस्खलन जोन के उपचार व मलबे को हटाने के लिए अगले पांच दिन आठ मई तक प्रतिदिन तीन बार...

-

Tula’s International School holds Confluence 2024

Tula's International School holds Confluence 2024

-

मसूरी में दर्दनाक हादसे में पांच छात्र-छात्राओं की मौत

Five students died in a tragic accident in Mussoorie

-

मुख्यमंत्री ने वनाग्नि, चारधाम यात्रा, पेयजल व विद्युत आपूर्ति को लेकर की महत्वपूर्ण बैठक

Chief Minister held an important meeting regarding forest fire, Chardham Yatra, drinking water and electricity supply.

-

देहरादून में भी कल से अवैध रूप से सड़क किनारे खड़े वाहनों के खिलाफ चलाया जाएगा अभियान

In Dehradun a campaign will be launched against vehicles parked illegally on the roadside.

-

Laser Run World Championship 2024 के लिए भी उत्तराखण्ड पुलिस ने क्वालीफ़ाई किया

Uttarakhand Police qualified for Laser Run World Championship 2024

-

चारधाम तीर्थयात्रियों के लिए बस किराया में वृद्धि

चारधाम यात्रा संयुक्त रोटेशन ने चारधाम यात्रा पर जाने वाले तीर्थयात्रियों के लिए नई किराया सूची जारी कर दी है। मालूम हो...

-

आज पांच जिलों में आंधी-बारिश का यलो अलर्ट

उत्तराखंड के पांच जिलों में शनिवार को तेज हवा और आंधी चलने के साथ हल्की बारिश के आसार हैं। मौसम विज्ञान केंद्र की ओर से...

World News

-

What is the Barbara Rhubarb dance and how did it turn into a TikTok trend?

You may have noticed an unusual German rap song in the background of an increasing number of videos on your TikTok feed....

-

Progress reported in Gaza ceasefire talks – but Israel plays down end to war

An Israeli official has downplayed the prospects for a full end to the war in Gaza as Egyptian state media reported "not...

-

British-Palestinian surgeon Ghassan Abu Sitta says French authorities denied him entry

A British-Palestinian plastic surgeon who has been operating on injured civilians in Gaza says he has been denied entry...

-

Man, 79, charged over 1966 Illinois murder after DNA breakthrough

A 79-year-old man has been charged with murder of an 18-year-old woman who was stabbed more than 120 times in her suburb...

-

Bodies found in search for Australian brothers and US man missing on Mexico surfing trip

Bodies have been found in the search for two Australian brothers and a US tourist who went missing in northern Mexico.Th...

-

India and Canada relations at their lowest ever in wake of Sikh leader Hardeep Nijjar’s killing

Diplomatic relations between India and Canada have been at their lowest since Prime Minister Justin Trudeau responded to...

-

Health warning issued as heatwave grips South and Southeast Asia

Countries in South and Southeast Asia have been coping with a weeks-long heatwave which has seen record temperatures swe...

-

Philippine coastguard hits out at China’s ‘brute force’ after water cannon attack

China has been branded "a bully" and an international lawbreaker after its ships blasted Philippine vessels with water c...

-

Dozens dead and roads turned into rivers as Brazil hit by record-breaking floods

Heavy rains in southern Brazil have killed 37 people, local authorities have said, with dozens still unaccounted for.Mor...

-

Three charged over killing of Sikh separatist leader in Canada – in incident which sparked diplomatic spat with India

Three suspects have been charged by Canadian police over the killing of a Sikh separatist leader in Vancouver last June,...

-

Crew member missing at sea during round-the-world cruise

A crew member on a 120-day voyage around the world is missing at sea. Ambassador Cruise Line's Ambience ship was making...

-

Bird flu: ‘Strong evidence’ suggests virus has passed from mammals to humans for first time

Scientists fear bird flu has spread from mammals to humans for the first time, marking another step in the evolution of...

Sports News

-

RCB are off the ventilator but still in the ICU: Ajay Jadeja

The Royal Challengers Bengaluru (RCB) picked up their fourth win of the IPL 2024 by defeating the Gujarat Titans (GT) by...

-

Heinrich Klaasen loses cool after being mobbed by fans in shopping mall, video goes viral

Heinrich Klaasen and Jaydev Unadkat visited a shopping mall amid the exhausting cricket schedule but it turned out to be...

-

LSG vs KKR IPL Records & Stats at Ekana Cricket Stadium, Lucknow – CricTracker

Third-placed Lucknow Super Giants (LSG) will be hosting the second-placed Kolkata Knight Riders (KKR) in Match 54 of the...

-

Lucknow vs Kolkata, Match 54: LKN vs KOL MPL Opinio Today’s Prediction – Who will win? – CricTracker

PreviewLucknow (LKN) will take on Kolkata (KOL) in the 54th match of the Indian T20 League 2024 on Sunday (May 5) at the...

-

IPL 2024: 3 changes GT should make to get back to winning ways

Bengaluru's Chinnaswamy Stadium was expected to produce a high-scoring thriller, but it turned out to be a one-sided low...

-

What is Joshua Little’s salary in IPL 2024?

Joshua Little bowled a good spell for GT in the latest match against RCB. The Irish pacer claimed four important wickets...

-

IPL 2024: Gujarat Titans 1st innings highlights against RCB in Match 52

Faf Du Plessis and his Royal Challengers Bengaluru side came into the game high on confidence having won their last two...

-

‘He just had a mild back stiffness so it was just a precautionary thing’ – Piyush Chawla on why Rohit Sharma played as Impact Player

Veteran Mumbai Indians batter Rohit Sharma recently featured for his side as the Impact Player against Kolkata Knight Ri...

-

Hardik Pandya has really struggled, he has looked like man under pressure: Graeme Smith

The Kolkata Knight Riders (KKR) picked up their seventh win of the IPL 2024 by defeating the Mumbai Indians (MI) by 24 r...

-

MI batters have lost them more matches than their bowlers: Harbhajan Singh

Harbhajan Singh came down hard on Mumbai Indians batters after their insipid performance against Kolkata Knight Riders o...

Trending Business News

-

Paytm President, COO Bhavesh Gupta to resign

Digital payments firm Paytm, formally known as One97 Communications Ltd (OCL), said on Saturday its President and Chief...

-

Birla Corp Q4 Results: Net profit up by 127% to Rs 193 crore

Birla Corp Q4 Results: Cement major Birla Corporation Ltd announced a sharp jump in its consolidated net profit to Rs 19...

-

Avenue Supermarts Q4 Results: Net profit rises 22.39% to Rs 563 crore

Avenue Supermarts Q4 Results: Avenue Supermarts Ltd, which owns and operates D-Mart stores, on Saturday reported a 22.39...

-

Volkswagen strengthens retail footprint with new store in Tamil Nadu

German automaker Volkswagen has inaugurated a new store in the city under its expansion drive in the state, strengthenin...

-

JK Bank Q4 Results: Jammu and Kashmir Bank reports highest-ever annual profit of Rs 1,767 crore

JK Bank Q4 Results: Jammu and Kashmir Bank on Saturday reported its highest-ever annual profit at Rs 1,767 crore for 202...

-

CDSL Q4 Results: Net profit doubles to Rs 129 crore

CDSL Q4 Results: Leading depository CDSL on Saturday said its net profit doubled to Rs 129 crore for the three months en...

-

IDBI Bank Q4 Results: Net profit jumps 44% to Rs 1,628 crore

IDBI Bank Q4 Results: Private sector lender IDBI Bank on Saturday reported a 44 per cent jump in net profit at Rs 1,628...

-

Tata Power Renewable Energy signs pact with SJVN for 460 MW clean energy project

Tata Power Renewable Energy Ltd (TPREL) on Saturday said it has signed an agreement with state-owned SJVN Ltd to set up...

-

Paper industry urges govt to allot degraded land for pulpwood plantation

The Indian paper industry has urged the government to provide degraded land on a long-term lease to paper mills for pulp...

-

Over 80,000 tech employees lost jobs globally in first four months this year in 279 firms: Report

More than 80,000 employees in the technology sector have lost jobs in the first four months this year, and layoffs conti...

-

MRF March Quarter Results: Net profit down 7.6%, margin shrinks by 50 bps; dividend declared

MRF March Quarter Results: Tyre maker MRF on Friday reported a standalone net profit of Rs 379.55 crore for the January-...

-

Tesla vs Tesla: US carmaker sues Indian namesake for copying trademark

Elon Musk's carmaker Tesla has sued an Indian battery maker for infringing its trademark by using the brand name "Tesla...

Entertainment

-

बीच कॉन्सर्ट में सुनिधि चौहान पर फेंकी बोतल, सिंगर ने ऐसे दिया करारा जवाब – India TV Hindi

Image Source : INSTAGRAM सुनिधि चौहान भारत की सबसे पसंदीदा सिंगर में से एक सुनिधि चौहान को लेकर एक परेशान कर देने वाली ख...

-

रणबीर-आलिया संग वरुण धवन के घर पहुंची राहा, क्यूटनेस पर फिदा हुए फैंस – India TV Hindi

Image Source : INSTAGRAM राहा कपूर रणबीर कपूर और आलिया भट्ट बॉलीवुड के सबसे प्यारे कपल में से एक हैं और उनकी बेटी राहा क...

-

वरुण धवन-जाह्नवी कपूर ने शुरू की ‘सनी संस्कारी की तुलसी कुमारी’ की शूटिंग – India TV Hindi

Image Source : INSTAGRAM वरुण धवन-जाह्नवी कपूर वरुण धवन और जाह्नवी कपूर दूसरी बार पर्दे पर साथ नजर आने के लिए तैयार हैं।...

-

बेटे अकाय के जन्म के बाद पहली बार मैच देखने पहुंची अनुष्का शर्मा – India TV Hindi

Image Source : X अकाय के बाद पहली बार मैच देखने पहुंची अनुष्का अनुष्का शर्मा और विराट कोहली अपने-अपने क्षेत्र, बॉलीवुड औ...

-

‘इंटरनेशनल फायर फाइटर्स डे’ पर एक्सेल एंटरटेनमेंट ने किया फिल्म ‘अग्नि’ का एलान – India TV Hindi

Image Source : X फायर फाइटर्स डे पर हुई नई फिल्म की घोषणा आज 'इंटरनेशनल फायर फाइटर्स डे' है। इस खास मौके पर फरहान अख्तर...

-

करीना कपूर को मिली बड़ी जिम्मेदारी, UNICEF ने बनाया नेशनल एंबेसडर तो हुईं इमोशनल – India TV Hindi

Image Source : X करीना बनीं यूनिसेफ की एंबेसडर करीना कपूर खान अक्सर अपनी फिल्मों को लेकर चर्चा में बनी रहती हैं। इसके सा...

-

‘भैयाजी’ के नए लुक में मनोज बाजपेयी को देख खड़े हो जाएंगे रोंगटे – India TV Hindi

Image Source : X 'भैयाजी' का नया पोस्टर रिलीज 'द फैमिली मैन','सत्या','गैंग्स ऑफ वासेपुर' जैसी कई फिल्मों में नजर आए मनोज...

-

धर्मेंद्र ने इशारों-इशारों में कह दी इतनी बड़ी बात, न जाने किस पर कसा तंज – India TV Hindi

Image Source : X धर्मेंद्र ने शेयर किया क्रिप्टिक पोस्ट धर्मेंद्र ने बॉलीवुड में एक लंबा और सक्सेसफुल करियर देखा है। अब...

-

बिपाशा बसु की डेढ़ साल की बेटी देवी स्विमिंग करती आई नजर – India TV Hindi

Image Source : X फैमिली के साथ वेकेशन एन्जॉय कर रहीं बिपाशा बिपाशा बसु भले ही इन दिनों फिल्मों से दूर हैं लेकिन वो फैंस...

-

‘ये रिश्ता क्या कहलाता है’ के राजन शाही ने अपकमिंग सीरियल का किया ऐलान, ये होगा टाइटल – India TV Hindi

Image Source : INSTAGRAM राजन शाही राजन शाही इन दिनों लगातार किसी न किसी वजह से चर्चा में हैं। निर्माता राजन शाही 'ये रि...

Technology News

-

India emerged as the most preferred market for tech giants: Apple CEO Tim Cook

India has become a key market for global tech giants, with a burgeoning developer base attracting significant attention....

-

IBM expands software availability to 92 countries in AWS Marketplace, including India

IBM has announced an expansion in the availability of its software portfolio, making it accessible in 92 countries throu...

-

Elon Musk’s X cracks down on deepfakes with improved image matching

Tesla and SpaceX CEO Elon Musk, on Saturday, said that a new update on "improved image matching" will defeat deepfakes a...

-

Indian Bike Driving 3D Cheat Codes May 2024 List

Indian Bikes Driving 3D is a popular Android game which is a spinoff of the GTA franchise. The game brings all the eleme...

-

Understanding Peer-to-Peer Crypto Trading: Benefits and Threats

When two individuals or entities decide to exchange any asset directly between each other, this process is referred to a...

-

AMD set to fuel growing demand for AI compute, says CTO

Chipmaker AMD is poised to power the surging demand for AI compute with its wide range of product portfolio, the company...

-

HCL Tech, Cisco launch ‘Pervasive Wireless Mobility as-a-Service’ for secured connectivity across enterprises

"HCLTech and Cisco launch Pervasive Wireless Mobility as-a-Service...This brings secure and mission critical connectivit...

-

Amazon Great Summer Sale: iPhone 15, iPhone 14 Listed With Discounts

Amazon Great Summer Sale 2024 is currently live for all shoppers after giving 12 hours of early access exclusively to Pr...

-

Best Smart TV Deals Under Rs. 30,000 During Amazon Great Summer Sale 2024

Amazon Great Summer Sale 2024 kicked off in India at 12am IST on May 2 for Amazon Prime members and is now accessible to...

-

Poco X6 5G Launched in a Third Colour Option in India: See Price

Poco X6 5G is now available in a new colour option in India. The smartphone was launched in the country in January this...

-

Amazon Great Summer Sale Begins: Best Offers Today

Amazon Great Summer Sale 2024 is now live for Prime members. The sale will open up for everyone else starting 12PM on Ma...

Know about online

-

India emerged as the most preferred market for tech giants: Apple CEO Tim Cook

India has become a key market for global tech giants, with a burgeoning developer base attracting significant attention....

-

IBM expands software availability to 92 countries in AWS Marketplace, including India

IBM has announced an expansion in the availability of its software portfolio, making it accessible in 92 countries throu...

-

Elon Musk’s X cracks down on deepfakes with improved image matching

Tesla and SpaceX CEO Elon Musk, on Saturday, said that a new update on "improved image matching" will defeat deepfakes a...

-

Indian Bike Driving 3D Cheat Codes May 2024 List

Indian Bikes Driving 3D is a popular Android game which is a spinoff of the GTA franchise. The game brings all the eleme...

-

Understanding Peer-to-Peer Crypto Trading: Benefits and Threats

When two individuals or entities decide to exchange any asset directly between each other, this process is referred to a...

-

AMD set to fuel growing demand for AI compute, says CTO

Chipmaker AMD is poised to power the surging demand for AI compute with its wide range of product portfolio, the company...